Run your third-party

EUDR Due Diligence system on

Big4-validated intelligence.

Connect our real-time, transaction-based EUDR API to access global legislation data, risk assessments, mitigation proposals, and document verification — automatically, for every transaction.

View Example Risk Assessment forRaw Wood from Indonesia

Streamline Your Compliance with

Kohtas EUDR API

1. Kohtas EUDR Onboarding

Define Goods by HS codes

Specify Business Locations

Provide Business Information

2. Fetch a List of Minimum Relevant Documentation for each Purchase Order

Based on the HS codes and countries (production areas), our API offers a list of the minimum documentation required for each Purchase Order. These documents must be obtained from your supplier or business partner and included in your records.

3. Seamlessly send transaction details through the Kohtas EUDR API for instant compliance verification.

Submit transaction details, including geolocation data and the required minimum documentation, from your due diligence system.

4. Fetch a Transaction-Level Risk Assessment with Relevant Legislation Information

Retrieve comprehensive analysis of documentation for each transaction, risk mitigation examples, and plot-level EUDR risk assessments conducted by leading accounting firms (Big4), ensuring compliance with EUDR.

Fully automated mitigation service that contacts suppliers directly with clarification requests related to the specific transaction. The Mitigation AI Agent manages supplier responses, validates new submissions, and updates the compliance status in real time.

Connect Kohtas API to Your Due Diligence Software -

Ensure Seamless EUDR Compliance.

EUDR Regulation API

Transaction-based, Percentage commission from transaction value (1,0 - 3,5%)

- A list of minimum relevant documentation requirements based on the HS code and countries of production for each Purchase Order.

- Comprehensive Global EUDR Risk Assessment by Leading Accounting Firms (Big4) for All Your Transactions.

- Relevant documentation for the purposes of the risk assessment, Art. 9 (1) (h), 10 EUDR.

- Risk mitigation examples if a risk arises in the submitted transaction.

- Validates transaction-specific documents in real time against EU Deforestation Regulation (EUDR) requirements. Leverages daily-updated regulatory data and risk assessments from Big Four firms to confirm authenticity, completeness, and compliance of submitted documents (e.g., landowner records, sales agreements, bills of lading, certificates, land cultivation rights).

-

Relevant legislation of the area of production

(Art. 3

(b), Art. 2 (40) EUDR):

Land-Use Rights, Environmental Protection, Third-Party Rights, Labor Rights, Human Rights, Anti-Corruption, FPIC, Tax, Customs, and Trade Regulations.

- Geolocation-Based requests

- Over 160 countries

- Automatic Daily Updates

- Fully automated mitigation service that contacts suppliers directly with clarification requests related to the specific transaction. The Mitigation AI Agent manages supplier responses, validates new submissions, and updates the compliance status in real time.

- No monthly or annual fees

- 24/7 Customer Support

- Enterprise solution: Seamlessly handles millions of transactions — across complex supply chains and global jurisdictions.

- Add "Regulatory Operating Cost" to invoices when the costs are transaction-based. Link to example case here.

- Trade Desk Compliance Verification: The API can be used by a bank's trade desk to verify EUDR compliance for letters of credit.

- Freight and Logistics: The API enables freight forwarders and carriers to validate EUDR requirements for each shipment or bill of lading in real time — before transport approval — ensuring regulatory compliance.

Making Sense of EUDR Compliance at Enterprise Scale

EUDR compliance is not just a reporting task — it is a data, risk, and transaction problem. Kohtas helps enterprises integrate EUDR legality and risk intelligence into their existing compliance stack.

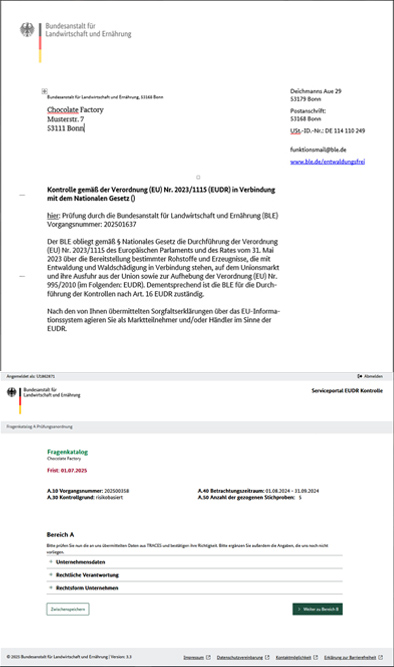

Ask ChatGPTExample: German BLE Audit Process under EUDR

-

1

Transaction-Level Verification

The German Federal Office for Agriculture and Food (BLE) performs EUDR checks on the basis of individual transactions. Each shipment connected to a Due Diligence Statement (DDS) can be selected for inspection, meaning that compliance is tested exactly at the transaction level required by the regulation.

-

2

Audit Notification by Email

When a transaction is chosen, BLE sends an official audit request by email to the operator. The message contains a secure link to the BLE online audit portal, where the company must upload all required supporting documentation (geolocation data, land-use rights, supplier contracts, invoices, etc.).

-

3

72-Hour Deadline and Consequences

Companies have a maximum of 72 hours to provide the requested documents. Missing the deadline, or providing incomplete information, may lead to the shipment being held at customs or blocked entirely from entering the EU market. This makes rapid access to reliable compliance data and risk assessments essential.

Open BLE slides here.. -

4

Future Criminal Liability Risks

In addition to financial penalties and operational disruptions, companies must prepare for the new Environmental Criminal Law Directive (Directive (EU) 2024/1203). By 21 May 2026, all Member States must transpose it into national law. Under this directive, violations of the EUDR prohibition in Article 3 may be punishable with imprisonment of up to five years, significantly raising the stakes for senior executives and compliance officers.

For full text and legal details, refer to Directive (EU) 2024/1203 of 11 April 2024 on the protection of the environment through criminal law, available on EUR-Lex.

Example of Cost Comparison: Kohtas vs. Manual Risk Assessment Processes with Legality Information for 100M€ EU Imports from Tens of Thousands Areas of Production

Managing compliance with the EU Deforestation Regulation (EUDR) can be costly and complex. Manual processes lead to high costs, inefficiencies, and increased risk of human error. Kohtas provides an automated, scalable, and cost-effective solution that streamlines compliance, saving you time and money.

| EUDR Risk Assessment Solution | Annual Cost (€) | Cost (% of Transactions) | Benefits |

|---|---|---|---|

| Kohtas | 3,5M€ | 3.5% (estimated range: 1.0 – 3.5%, depending on HS codes and countries) | Fully automated, fast, accurate, scalable, and produced by leading accounting companies (Big4) |

| Manual Risk Assessment and Gathering of Relevant Legislation Information | 5M€ – 20M€ | 5–20% | Labor-intensive, prone to delays and errors |

Key Advantages of Kohtas

- Cost Savings: Reduce compliance costs by up to 80% compared to manual processes.

- Scalability: Handle millions of transactions seamlessly, regardless of complexity or geographic diversity.

- Accuracy and Risk Mitigation: Leverage real-time data and automated legal checks to minimize errors and ensure compliance.

- Predictable Pricing: Transaction based pricing. Pay only if you have EU sales, with no hidden fees or additional costs.

Kohtas combines advanced technology, real-time information, and expert insights to deliver the most reliable compliance solutions for EUDR-regulated industries. Whether you're trading high-risk commodities or operating across multiple countries, Kohtas simplifies the process, allowing you to focus on your core business.

Kohtas EUDR Mitigation AI Agent - Automated Call to Supplier

About Kohtas

At Kohtas, we've built a marketplace where the sellers are

leading accounting firms (Big4) and legal firms with unparalleled

expertise in global regulations. They curate and update

regulation rules and produce risk assessments daily, ensuring

the data we provide is always accurate and up-to-date.

With our unique business model, you only pay when you do

business, and we take a percentage commission from

each transaction. This approach is not only cost-effective but also allows you to

switch from fixed regulation information costs to variable

costs.

Embark on Your Kohtas Journey:

Simple 3-Step Onboarding

Process

-

1

Define Your Goods by HS codes

In the first step of the onboarding process, you'll need to specify the goods your enterprise offers under the EUDR by HS codes.

-

2

Specify Business Locations

In this step, you'll specify where your business operates from and where it delivers to example by GPS coordinates. This will help us identify the specific regulations based on the geographical regions involved in your operations.

-

3

Provide Business Information

Finally, you'll provide some additional business information. This includes your total sales volume in million euros, and your enterprise name. This information helps us understand your scale of operations and customize our offerings accordingly.

The Complete EUDR Compliance Stack

Connect Your ERP, Due Diligence Software, and Kohtas API Automate EUDR compliance with real-time risk assessments, global legislation data, and seamless ERP integration.

Enterprise Resource Planning (ERP)

SAP, Oracle, Dynamics 365, Sage, Infor, Workday etc.Connect your ERP with Kohtas EUDR API to automatically retrieve the minimum required documents for each HS code and country. Ensure every global purchase order includes the correct, EUDR-compliant documentation — without manual review or data entry. Fully scalable and compatible with existing enterprise systems.

EUDR Due Dilligence Software

Your own developed solution, Satelligence, Osapiens, Koltiva, IOV42, Optel Group...

Kohtas EUDR API

Fully automated, fast, accurate, scalable, and verified by leading Big4 accounting firms.

Land-Use Rights, Environmental Protection, Third-Party Rights, Labor Rights, Human Rights, Anti-Corruption, FPIC, Tax, Customs, and Trade Regulations.

Let's Make EUDR Compliance easier, together

Contact us today to discover how Kohtas simplifies EUDR compliance for your business.